I will confess to being a little ‘old school’ in my approach to trustees’ duties. Because trustees are handling other people’s money, I really like black-and-white rules.

Of course, in real life there is a lot of ‘grey’, but this grey can usually be solved – after a little consideration – by a policy that says “If in doubt, don’t do it”. In this way the grey is all converted into black, life is simple, and the beneficiaries benefit from the most risk-averse approach, which in most cases should guarantee their interests are protected.

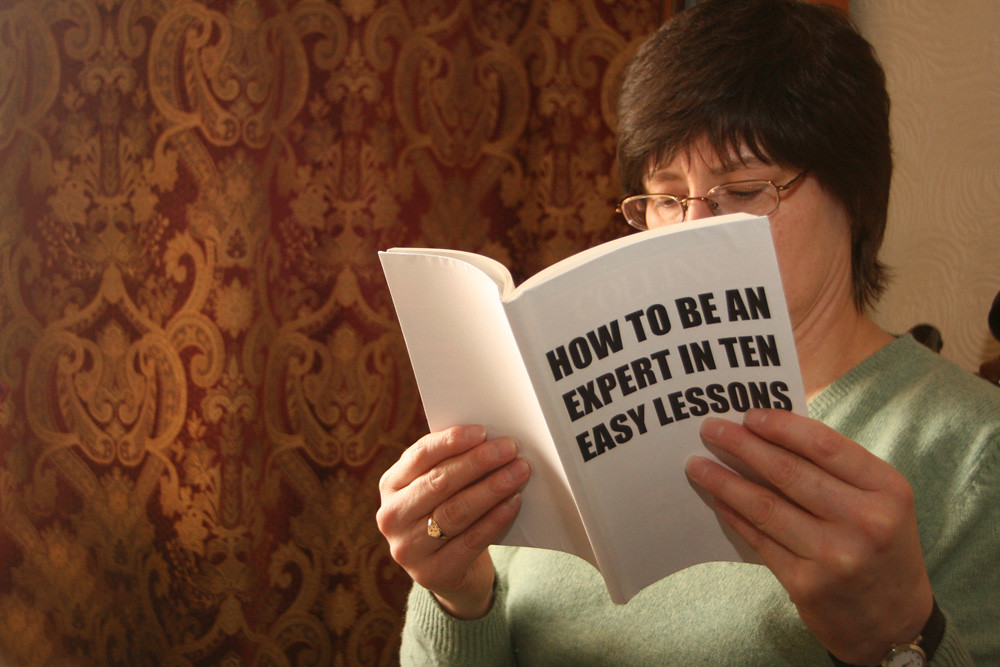

But perhaps I am a dinosaur? Perhaps the fiduciary world is changing and I have failed to keep up?

A recent decision of the Royal Court in Jersey: Re May Trust [2021] JRC137, has forced me to rethink a few things. This decision seems to have slipped under the radar, but I think it is very significant for trustees.

Let’s explain using hypotheticals:

Hypothetical 1: Money in the bank

I am managing $1 million of a client’s money which is in a bank account. Let’s assume that keeping the money available at call is important in this case and that the money is sitting in an operating bank account (0% interest).

I am aware that the bank in question has an overnight call facility that offers 5%. Switching the money to this account does not affect risk or liquidity.

What should I do?

In my black-and-white world, there is no option here. I MUST put the money in the call facility. If I do not do that, I am in breach of my duty to act in the best interests of the trust and of the beneficiaries – and I believe that I would be personally responsible (and personally financially liable) if I failed to do it.

Hypothetical 2: Paying Tax

I have two different ways of doing a transaction. One way would result in a tax liability for the trust, and the other way not. In all other respects, the two versions are identical

What should I do?

In my black-and-white world, I MUST choose the tax-free method – based on the same logic as hypothetical 1.

However, we live in a changing world. A world in which ESG is not just a word but it is also a new way of life. It is not all just about money anymore. Other things are important too – stakeholders, society, the environment and moral principles.

Here is the third hypothetical:

Hypothetical 3 – Paying Tax – Version 2

I have two different ways of doing a transaction just as in hypothetical 2. One results in tax liability, and one does not.

The difference here is that the founder of the trust asks me to choose the taxable way. Her reasoning is that she feels that by paying tax, the trust, and therefore indirectly her family, is delivering a social good. She points out that the family constitution envisages a wider role for the trust – not just securing the family’s financial future but also achieving socially beneficial purposes. I check the trust deed and find there is nothing (except my internal ‘moral alarm’) that would prevent me from doing what she asks.

In my black-and-white world, I would think long and hard on this point, but in the end, the dinosaur me would choose the tax-efficient way. That’s because my duty is not to the founder. Instead, it is collectively to the beneficiaries as a whole – including small children and the unborn. Paying unnecessary tax might not be in their best interests (I have no way of knowing) and therefore I would most likely refuse to do so.

But perhaps I am wrong?

The facts of the case Re May Trust are not quite the same as hypothetical 3, but they are getting close:

The trustee in that case was asked to make a distribution to a charity that was a beneficiary of the trust. The trustee had the power to make the distribution and was happy to do so.

The trustee could have made the distribution to the charity directly – with no tax consequences. However instead the principal beneficiary asked that the distribution be made to him personally on the basis that he would then personally donate it to the charity. Doing it this way meant that the beneficiary (not the trust) would have a significant tax liability – and it was a lot of money (£ 75 million).

In my black-and-white world, I am not so sure that this is a problem, but some thinking is required. The reason it might be OK is that there is no negative impact on the trust itself as the tax obligation falls on the beneficiary – and what he wants to do is arguably between him and the tax authorities. On the other hand, if you think of this as a way to get money from the trust to the (beneficiary) charity, then it is a problem because the charity ends up with 25% less money this way. Finally, my objective as a trustee is to provide benefits to beneficiaries. Is providing money so that they can pay unnecessary tax providing a benefit? I really don’t know. Neither did the trustee, which in that case was IQEQ. So they went to the court for guidance.

The court decided that the distribution (including by implication the money to be paid in tax) did qualify as a benefit to the beneficiary. Not every benefit needs to be a financial benefit. The court said that meeting the family’s social justice aspirations is also a benefit.

Does that affect my decision in hypothetical 3? Perhaps it does, but only if the family as a whole (not just the founder) supported the tax payment – as they did in the May case.

I see this as a really positive development. Families and their trusts and foundations are not always just about money and they never have been – and it is great to see the courts recognising this.

On the other hand, this new world creates some new challenges for us dinosaurs. Here’s hoping we manage to adapt.